hotel tax calculator bc

Hotel Room Rates and Taxes. 7-PST on hotel rooms is 8.

Banking Finance Thin Icons Creative Market Finance Bank Banking Finance

Please note that campsite and RV site rentals are exempt.

. Purchase Price 20000. Taxable and Exempt Accommodation Definitions For the purpose of PST and MRDT. 2 on the balance up to and including 2000000.

1 on the first 200000. BC Revenues from Sales Taxes. 3 on the balance greater than 2000000.

21 In this regulation unless the context otherwise requires section 1 of the Act shall apply. Additional tax on lodging Saskatchewan 5 6 - Additional tourism levy on hotel rooms Yukon 5 - - TAX BY PROVINCE OR TERRITORY. A tax rate increase will only take effect after an application has been approved by regulation.

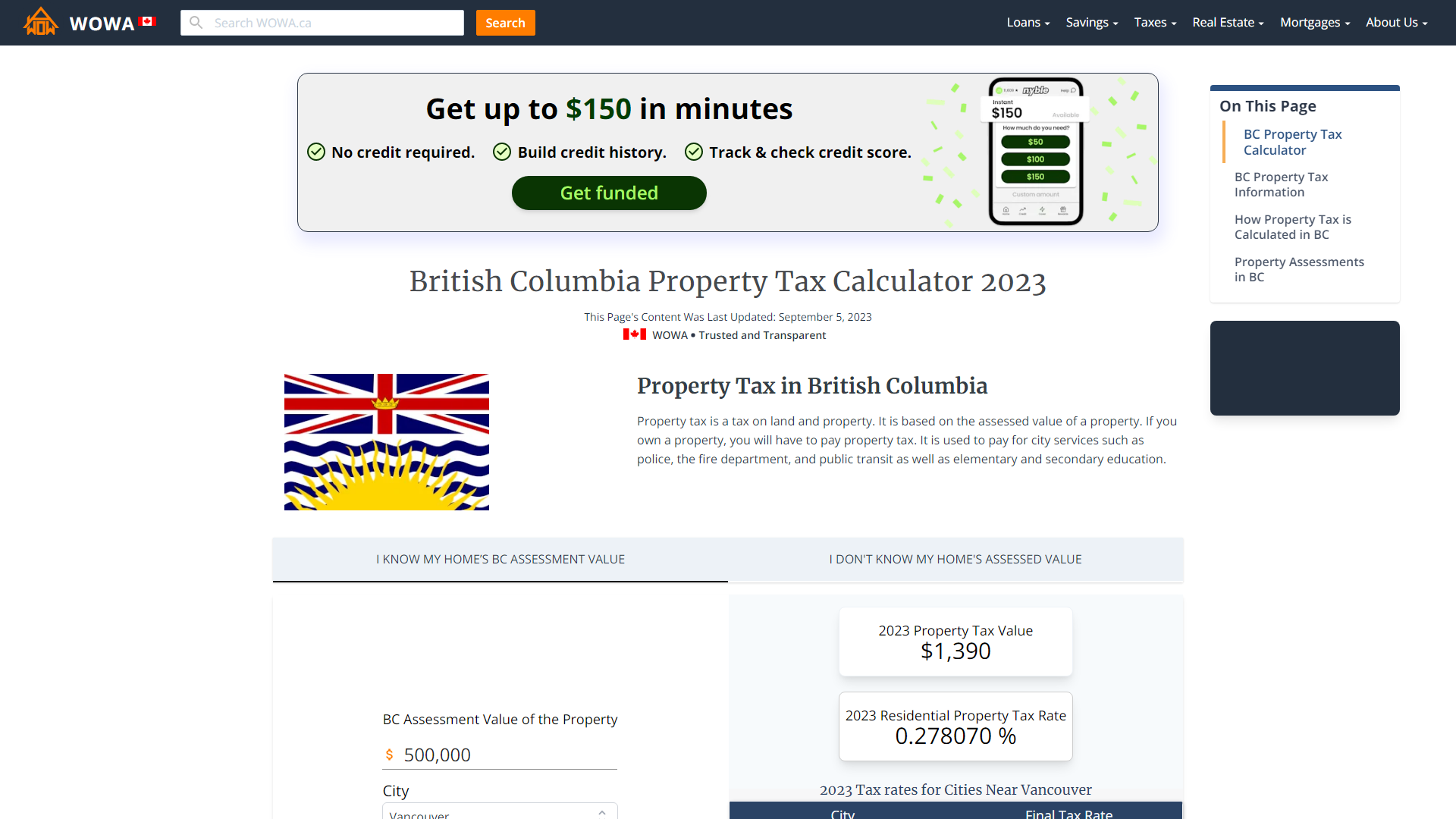

Where the supply is made learn about the place of supply rules. Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax. However it is less progressive when levied on short-term housing for low-income people.

This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services This amount is either 18 of your earned income in the previous year or. Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax. The rate you will charge depends on different factors see.

Current GST and PST rate for British-Columbia in 2021. Take for example a salaried worker who earns an annual gross salary of 45000 for 40 hours a week and has worked 52 weeks during the year. Kelownas DMF may be 15.

March 31 - Final payment with return. When all the rates have been selected click on any of the Calculate buttons to the right of the table. Type of supply learn about what supplies are taxable or not.

Hotels motels resorts boarding houses rooming houses and bed and breakfast establishments. The City of Vancouver recently announced that the Vancouver Empty Home Tax will increase to 3 in 2021 compared to 125 in 2020. The instalment payment due dates are.

Destination Marketing Fee 200 x 15 300. The information used to make the tax and exemption calculations is accurate as of January 30 2019. 8 rows Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

This new rate will apply to all applicable properties in the 2021 reference year from January 1st 2021 to December 31st 2021. This is greater than revenue from BCs corporate income tax and property tax combined. Select hotels in Vancouver levy an additional 15 Destination Marketing Fee DMF on top of the 2 MRDT which makes a total of 35 additional taxes on some accommodation in Vancouver.

If the property is residential a further 2 on the portion of the fair market value greater than 3000000. Our calculator has been updated for the new tax rate. Some communities such as Downtown Victoria have an additional Destination Marketing Fee of 10 which I believe is voluntary.

The following table provides the GST and HST provincial rates since July 1 2010. On April 1st 2013 the government removed the HST and replaced it by provincial sales tax PST and GST in British-Columbia. Your instalment payments are estimated to be.

PST 203 x 8 1624. 45 000 - Taxes - Surtax - CPP - EI 35 57713 year net 35 57713 52 weeks 68418 week net 68418 40 hours 1710 hour net You simply need to do the same division for the gross. It is generally progressive because it is paid by businesses and higher income earners who are more likely to stay in hotels when they travel.

You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax TablesUse the simple annual British Columbia tax calculator or switch to the advanced British Columbia annual tax calculator to. Accommodation includes lodging provided in. No hotel tax or levy YUKON No hotel tax or levy BEYOND CANADA NEW YORK STATE New York State legislation plus munic-ipal andor county authorizations to collect taxes on their behalf Statewide NY State Department of Taxation and Finance.

You will then go to Screen 3 which shows the individual tax rates selected the total tax rate the assessed value input and. GST 5 PST 7 on most goods and services. Your instalment payments are estimated to be.

Who the supply is made to to learn about who may not pay the GSTHST. 22 Accommodation includes the provision of lodging in a lodging houses boarding houses rooming houses resorts bed and breakfast establishments and similar places. This calculator should not be considered a substitute for professional accounting or legal advice.

1 This regulation may be cited as the Hotel Room Tax Regulation. The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association. Hotel Room Rates and Taxes.

For example if your hotel is located in Vancouver which is subject to a 2 MRDT and a 15 destination marketing fee and you provide a room in your hotel for 200 per night your guest pays. Alberta 5 - - Additional tourism levy on hotel rooms British Columbia. Select the appropriate tax rates for the desired service area and property class by clicking on the box to the right.

A hotel and accommodation tax or levy is a specific fee on hotel or motel charges. For most residential properties the general property transfer tax calculation is as follows. In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations with four or more units.

The British Columbia Annual Tax Calculator is updated for the 202021 tax year. Some communities such as Downtown Victoria have an additional Destination Marketing Fee of 10 which I believe is voluntary. Kelownas DMF may be 15.

Revenues from sales taxes such as the PST are expected to total 7586 billion or 225 of all of BCs taxation revenue during the 2019 fiscal year. Sales taxes make up a significant portion of BCs budget. Collected monthly New York City 14375 combined sales hotel and local taxes plus 350 per night.

2 Municipal and Regional District Tax MRDT on lodging in 45 municipalities and regional districts. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada rate 5 for a total of 12. Since your employer health tax is over 292500 you are required to make quarterly instalment payments.

MRDT 203 x 2 406. Hotel and accommodation taxes.

Set Of Color Flat Design Icons By Creative Graphics On Creativework247 Flat Design Icons Icon Design Web Design Icon

How To Calculate Hotel Tax Canada Ictsd Org

Second Hand New International Tax Advisor Tax Advisor Post Free Ads Advisor

How To Calculate Hotel Tax Canada Ictsd Org

Realtymonks One Stop Real Estate Blog Real Estate Marketing Real Estate Easy Loans

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

My American Dream Essay Examples In 2021 Essay Examples Essay Nursing Study

British Columbia Gst Calculator Gstcalculator Ca

Mortgage Rates Are Now Breaking To New Lower Territory And They Could Stay There For Months Real Estate Estates Rural Real Estate

Download Accounting Flat Banners For Free Accounting Vector Free Banner

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Asian American Masculinity A Review Of The Literature In 2021 Asian American Nonfiction Writing Essay

Tax Tip Can I Claim Nursing Home Expenses As A Medical Expense 2022 Turbotax Canada Tips

City Of Bethlehem City Real Estate Investing Bethlehem

Mainstream Hdb Rental Could Weaken Our Communities Reshape Social Norms Sim Ann In 2021 Community Home Ownership Sims